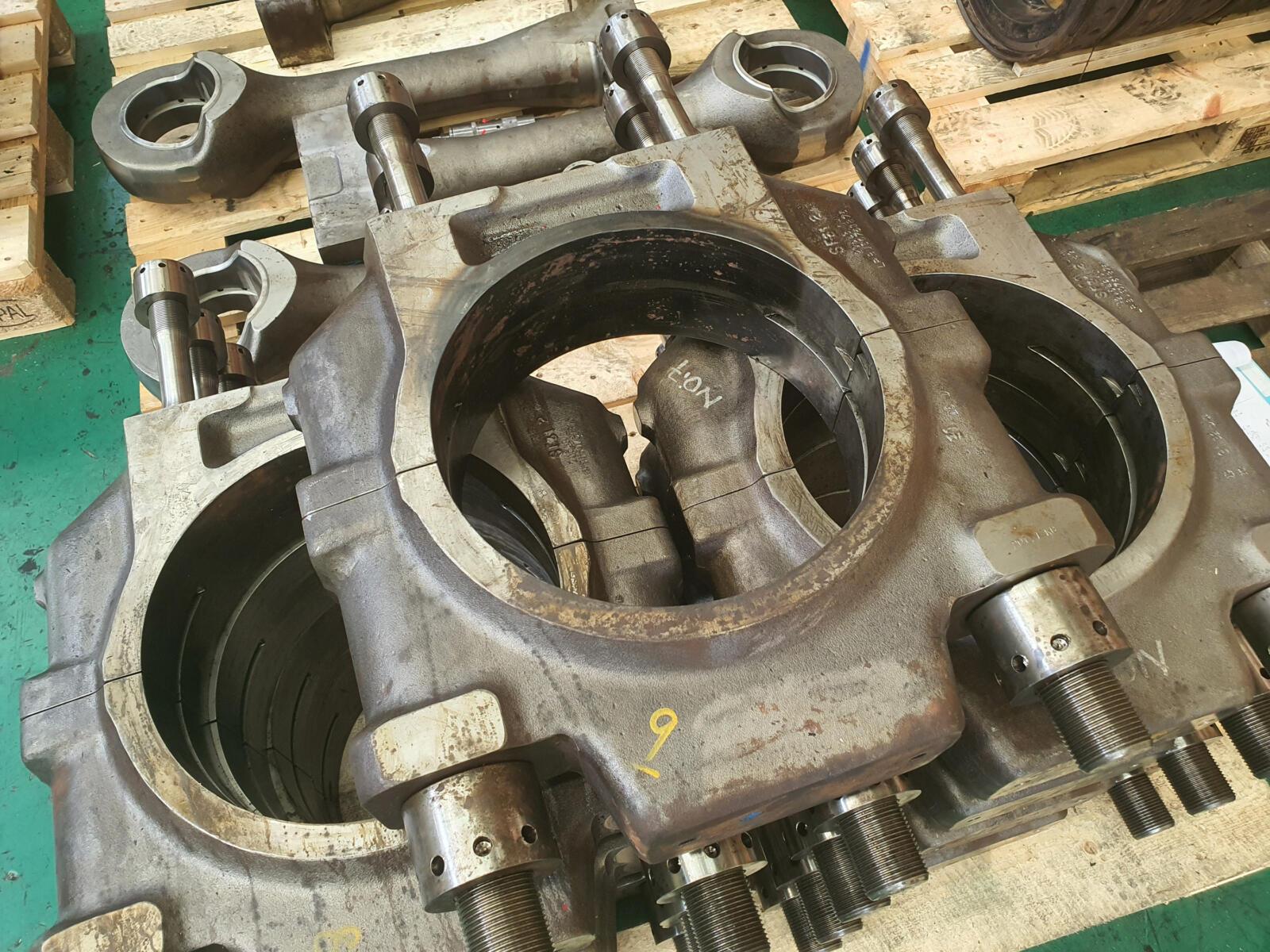

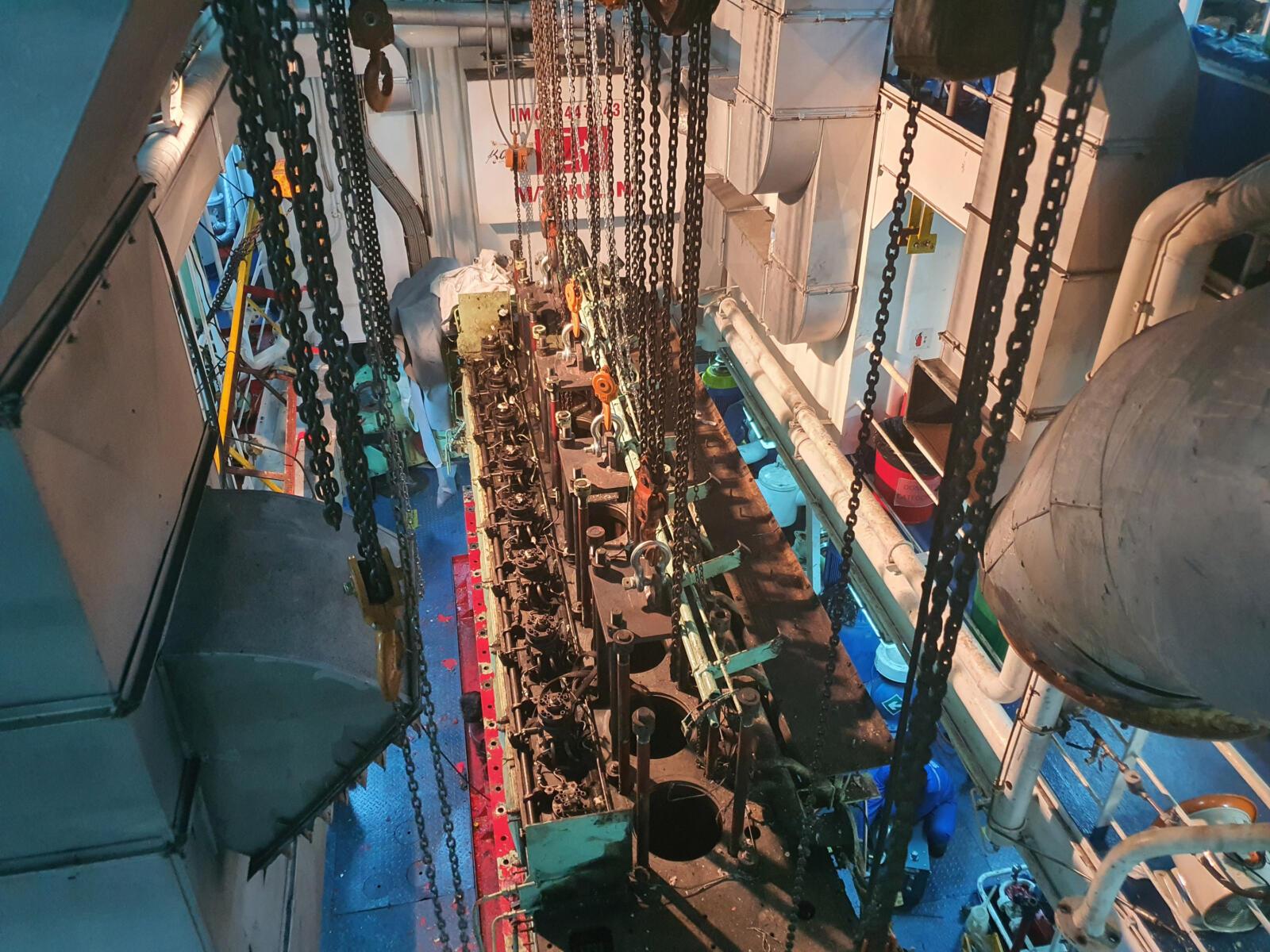

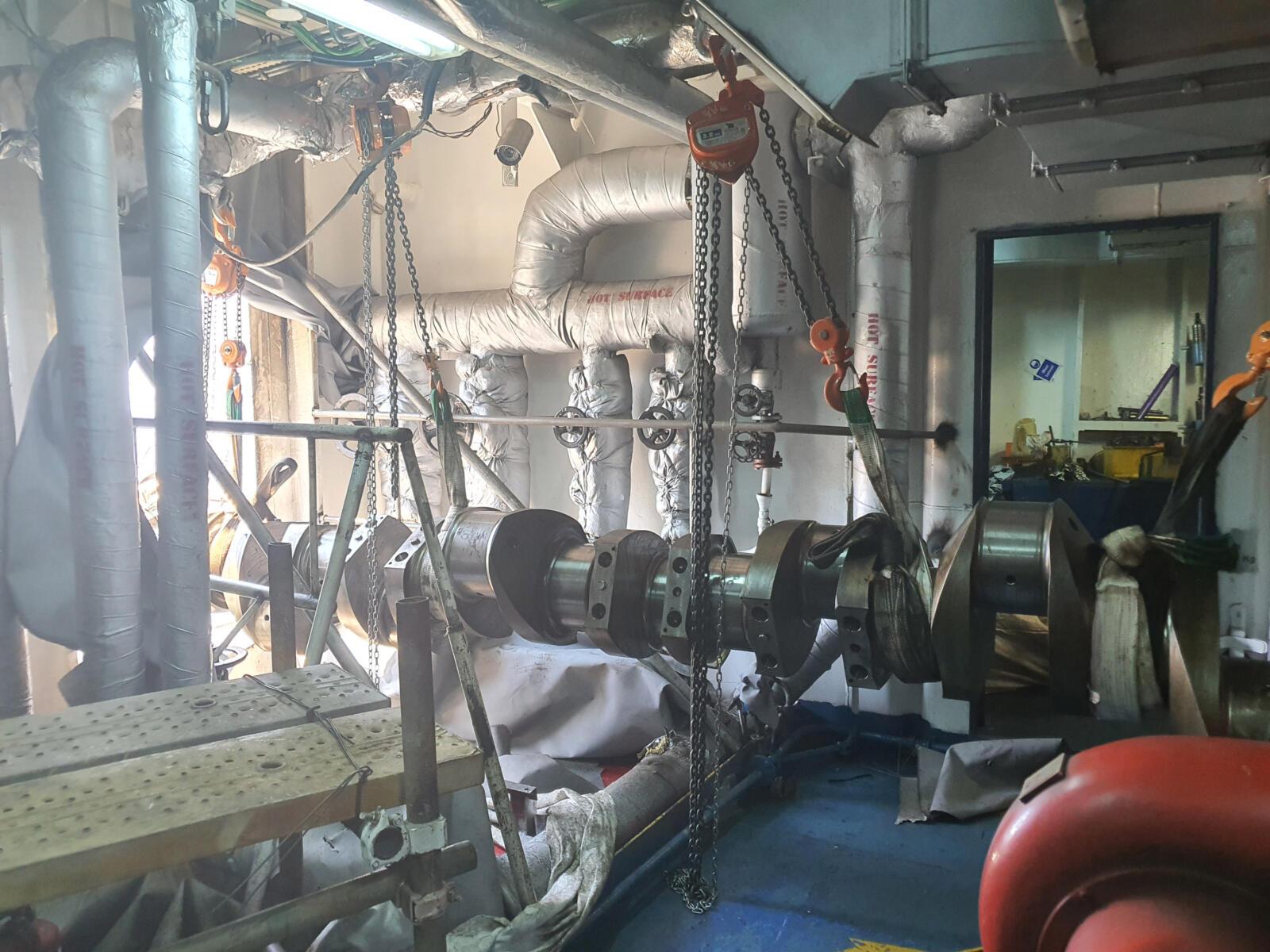

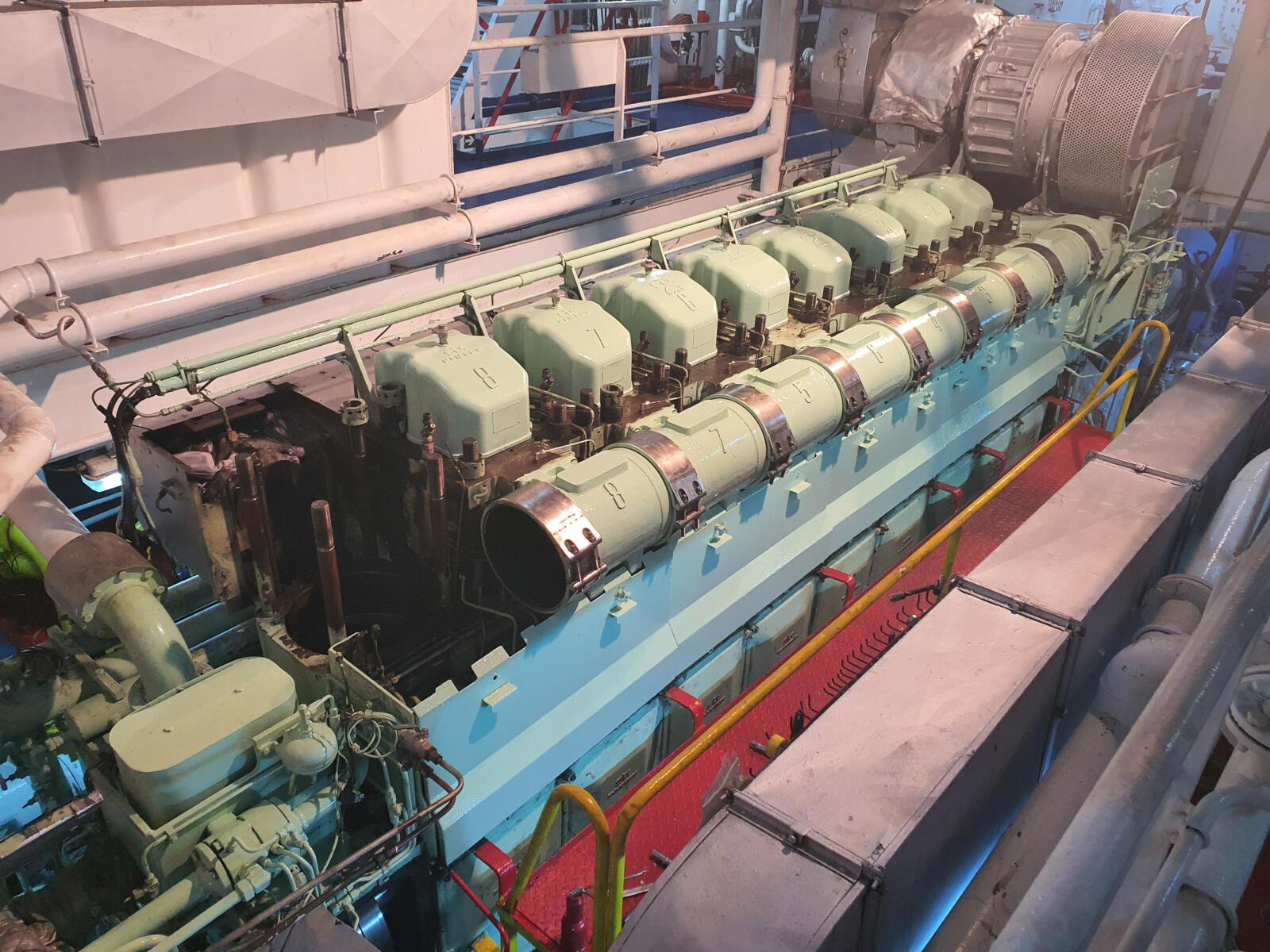

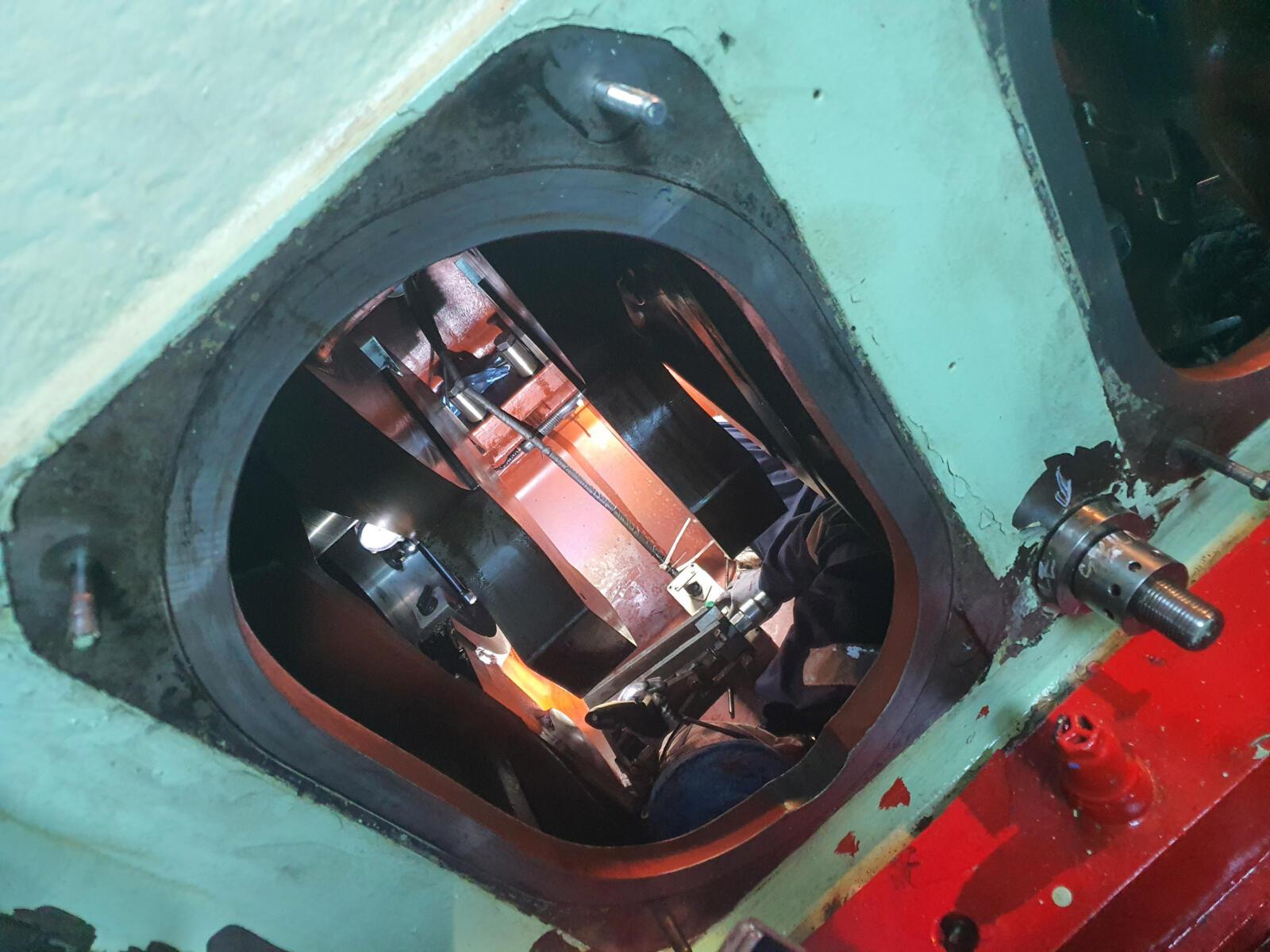

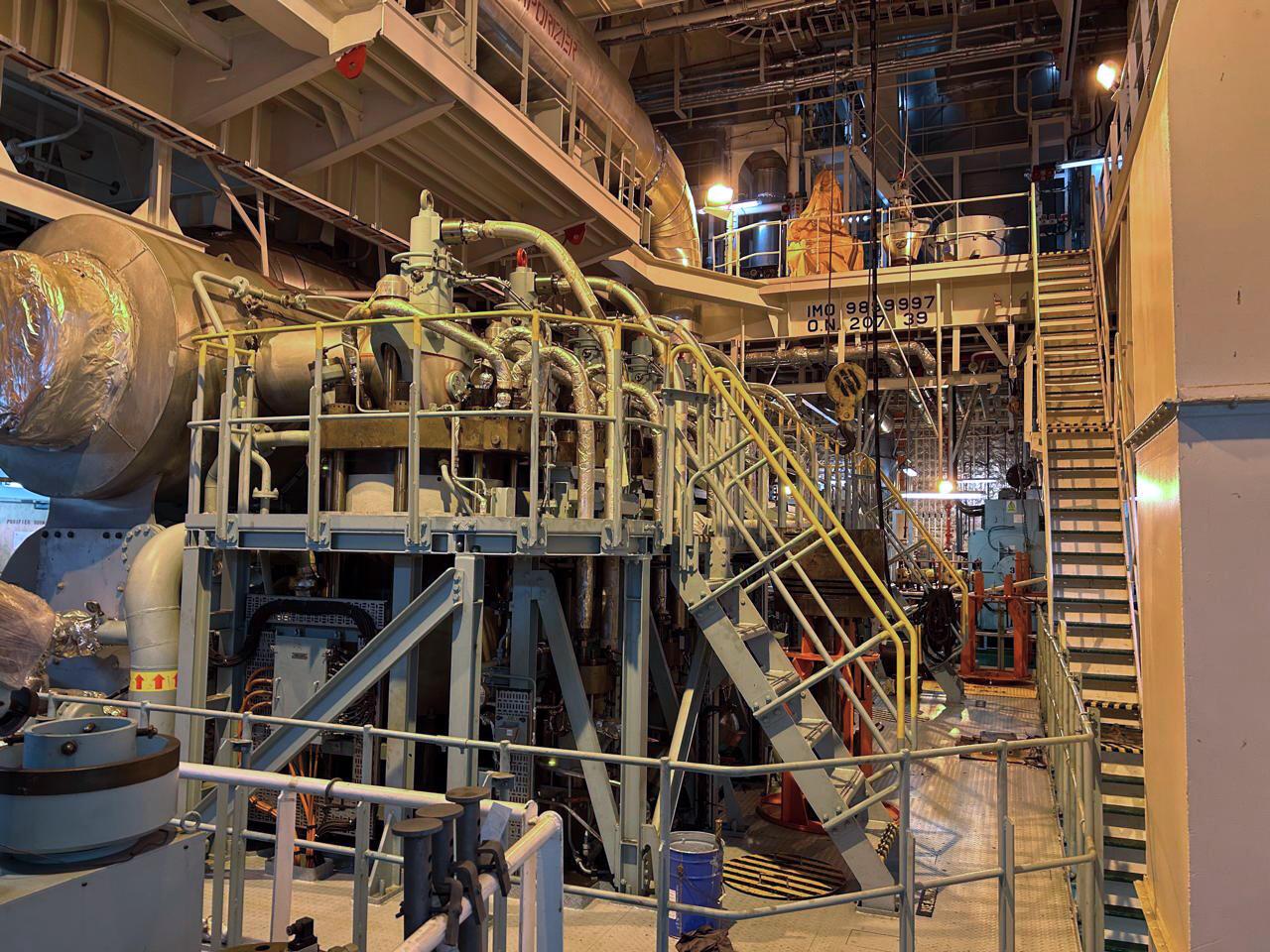

A 4-stroke main engine crankshaft renewal

Stacked big ends, hanging engine blocks and hull cropping – typical view of a 4-stroke main engine crankshaft renewal.

Despite various attempts for saving the crankshaft, renewal of the same was considered inevitable on account of severe damages on one crankpin. Makers offered a crankshaft with a delivery time of 4 months.

As a result of this, our Shanghai Office attending on behalf of both H&M and LOH, immediately located a new crankshaft in China in order to mitigate the repair cost and time.

The crankshaft was dispatched to South Korea in a timely manner and repairs completed in the shortest possible time.

Catastrophic fire incident burned 4 yachts - including a 1929 classic sailboat

Catastrophic fire incident burned 4 yachts, including a 1929 classic sailboat.

Our Piraeus Head Office immediately dispatched a Surveyor on-site at Corfu, having been instructed by the Liability Insurers of the Marina. Upon initial meeting with all parties involved, swift decisions where taken in order to remove the wrecks ashore, by use of a 75MT capacity floating crane.

Although all yachts were unfortunately lost, congratulations are due to the Marina personnel and all involved parties for their successful efforts to prevent and eliminate any pollution, and remove the yachts ashore for recycling.

Thankfully there were no injuries during or after the incident.

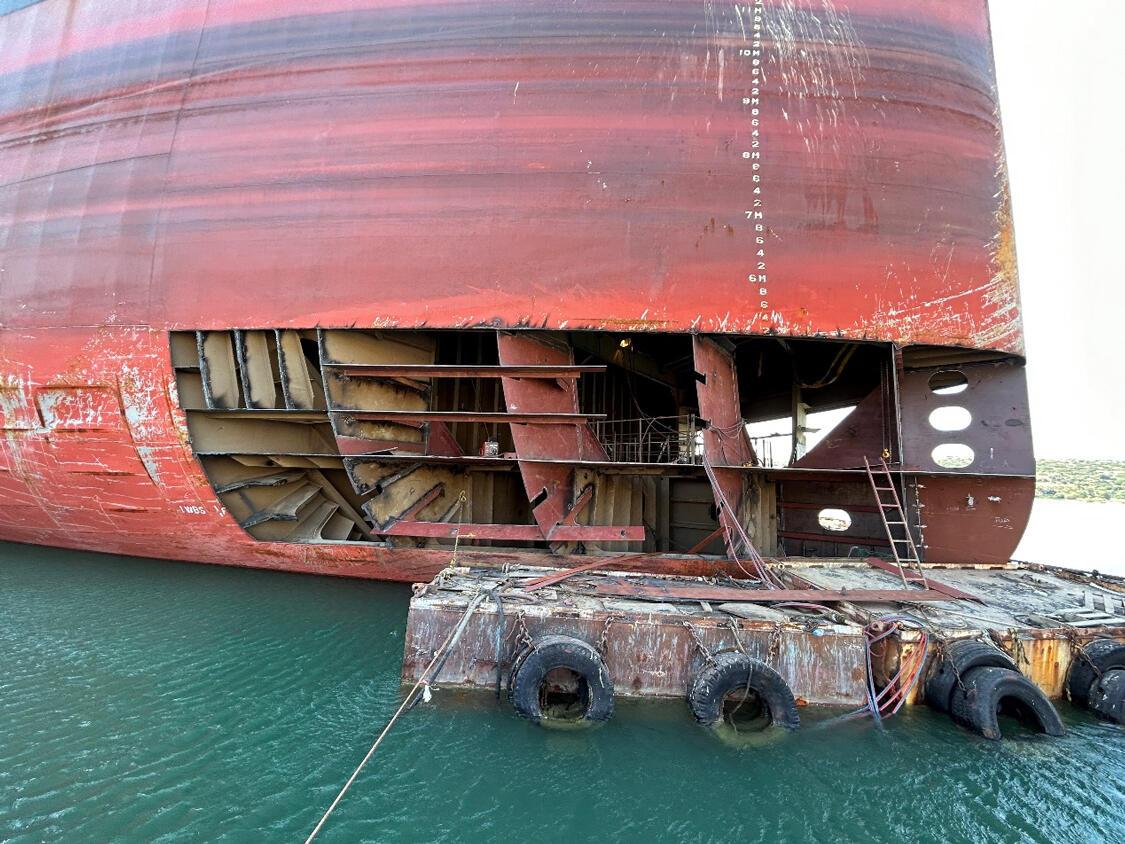

MAJOR COLLISION AND SUBSEQUENT BEACHING OF FULLY LADEN BULK CARRIER OFF GIBRALTAR

On 29th August 2022 a bulk carrier fully laden with some 33,632 MT of steel rebar, collided against an LNG Carrier during departure from Gibraltar western anchorage, which caused breach of the forward cargo holds, resulting to the Master deliberately beaching the vessel off Catalan Bay Beach to avoid her sinking.

Our Gibraltar Office was instructed to attend on behalf of H&M Underwriters and P&I Insurers. Our Senior Surveyor Matthew Byrne immediately coordinated with involved parties and made urgent arrangements to attend on board at Eastside anchorage to ascertain the circumstances that led to the collision and subsequent beaching, as well as the extent of damage to the vessel.

At the time of our attendance the vessel’s bow was resting on the vessel’s seabed at a depth of approx. 17m, whilst No.1 cargo hold and deck was fully submerged under water and No. 2 & 3 cargo holds full with water up to sea level (tidal).

In the initial stages of the casualty, extensive efforts were made to coordinate all responsible parties, whilst constant communication was established with Gibraltar Port authorities for mobilizing all resources necessary for minimizing potential oil pollution impact during Salvage operations.

In close cooperation with the SCR on board, assessment of the possibility of vessel’s refloating was carried out, in order to shift her to a safe berth. Additionally, contingency plans were jointly formed and an Emergency Team was established from our Office in order to facilitate effective communication and coordination between all parties / authorities.

During salvage operations on 31st August, vessel sustained catastrophic failure/breakage of the hull girder in way of Fr. 135 (buckled and sheered), rendering the potential repair of the vessel beyond economic and/or technical viability. H&M Underwriters were timely advised regarding the loss and from that point onward all efforts concentrated in the efforts and inspections for the prevention of pollution in the area.

Given the hull breakage, the HM Government of Gibraltar declared a major accident (MAJAX) under the provisions of the Civil Contingencies Act, which in turn dictated that all available resources would be directed for dealing with the emergency. Thus, all other daily operations at Gibraltar Port were interrupted to ensure availability of resources and as a result:

- All GPA service crafts remained on standby;

- All anti-pollution booms at GPA’s disposal were deployed;

- Vessels deployed in U-formations with booms in order to start collection in the event of further oil spill from the vessel or the primary boom;

- Additional booms were deployed along the coastline which was at risk of direct impact;

At our Firm’s initiative and after advising the P&I Club accordingly, we carried out beach / shore line surveys of the local Gibraltar and Spanish coastlines to assess and document the extent / impact of oil pollution in the area. At the same time, we were in close cooperation with the ITOPF Technical Advisor who was eventually later engaged for further beach & shoreline surveys.

The wreck removal tendering process is in progress to the date of this article, under the coordination of the attending SCR, whilst the cargo still remains in the vessel’s cargo holds. During the entire duration of our attendance on board, continuous monitoring of the subcontractors’ costs was carried out for continuous and proactive reporting to our Principals.

Ice Damages

Main Types – Repairs – Implications to Underwriters

According to our database and discussions with clients and colleagues, ice damages have been a rising trend within the winter of 2023-2024 compared to previous years, especially in the Baltic Sea, which has been largely covered by ice.

2024 began with the early arrival of winter in norther Europe. In reality the first cold spell started in late November 2023, which cooled down the sea temperature, followed by the next cold sweep which began at the turn of the year.

According to the Finnish Meteorological Institute (FMI) reports, the overall ice extent in the Baltic Sea in early January 2024 was four times the average, however, the maximum sea ice extent in the Baltic Sea (sq. km) barely exceeded the average by February 2023.

Despite the fact that the coverage of the Baltic Sea was in essence “normal”, key ports within the Baltic were heavily covered by packed ice this winter, resulting in several similar claims from ice damages sustained by vessels operating in the region.

The other location that brings rise to several ice damage claims are the ports of northern Canada, near the arctic route. The remote location and heavy ice pack concentration in these ports are responsible for multiple occasions of ballast structural damages.

Main Types of Ice Damages

There are two main types of Ice Damages, we have encountered recently, that gave rise to H&M and/or LOH insurance claims:

- Propeller Damage

- Structural damage (fwd)

Propeller Damage

This is one of the most usual types of damage that arises due to contact with thick ice formations. It is typical that vessels in ballast condition entering / departing from ports or even during shifting within the port, suffer damages of varying nature/extent or severity in way of propeller blades, due to practically unavoidable contact with thick ice.

Damage: The nature of these damages is typical and distinct, in most cases compatible or symmetrical on all blades, consisting of blade tips bent in a similar uniform manner, by rotating in icy water.

When such damages occur, they are most commonly identified after vessels clear the icy waters areas and increasing the M/E rpm, either in the form of increased vibration or increased M/E load at continuous rating. In case of severe or uneven blade damages, the M/E load limiter may be triggered at very low rpm/speeds, rendering the vessel unable to safely continue voyage as M/E rpm cannot be increased above slow ahead rating.

Repairs: In most instances, and if the propeller blades are affected outwards of 0.7- 0.75R (of the blade’s radial span), the most cost / time effective way to deal with such damages is to carry out temporary repairs afloat by symmetrical underwater cropping of all blades at lay-by berth, always subject to severity, propeller Makers’ / Class recommendations and approval. Such temporary repairs would re-instate the propeller balancing, thus mitigating risk of consequential damages to stern tube bearings or M/E, restoring M/E in good working order at continuous rating, thus allowing vessel resuming voyage at normal speed.

Permanent repairs are deferred, until suitable repair facilities options are examined and schedule meets the trading pattern of the vessel, always within the ‘window’ prescribed by the Class (per COC time limit imposed).

It is important to note that the weight balancing of the propeller has to be restored in case of temporary repairs. Thus, if only one blade has been deformed or the deformation of opposite blades is variant, the affected blades cropping has to be symmetrical (removing equal mass quantum on opposite blades) to restore balancing, irrespective if one of the blades may not be affected at all.

Permanent repairs of the propeller involve welding of new inserts at tips per original dimensions/ material specification, always subject to Class rules and acceptance. The whole process involves drydocking of the vessel, removal of the propeller and transportation to suitable shore facility, with subsequent refitting on completion. The repair time usually varies between 7-10 days, excluding any waiting time for blade tip manufacturing and delivery on-site.

In case dry-docking space is not available, and provided that conditions and vessel’s design permits, the removal / refitting of the propeller may be carried out alongside afloat, with vessel trimmed by the bow.

In case the damage to any blade is more severe and thus beyond permitted permanent repair, propeller renewal is sustained mandatory. In such cases, prompt ordering of a new propeller from Makers is vital to save long delivery times, whilst additional repairs / works are required, such as withdrawal of tailshaft and blue fitting of tailshaft/propeller tapers.

Moreover, forwarding cost / time of a complete propeller from the manufacturers’ works to the place of repair has been proven to be a challenge and costly. All the above, effectively sustain propeller renewal generally a more costly and more time-consuming option than blade tip repairs.

Structural Damage

The second most frequently encountered ice damage is structural, more commonly damage in way of the forward parts of the vessel such as the bulbous bow / FPT or at higher levels if the vessel is in laden condition, sometimes extending to shell plating further aft (in way of Water Ballast tanks / Cargo Holds).

Damage: These damages have almost always a symmetrical nature (P&S) as they occur during vessel’s passage through thick ice formations. The shell plating and internals in way of the FPT and bulbous bow are usually found symmetrically set-in / deformed, and on occasions breached.

Repairs:

Temporary repairs: May be required in case the structural or watertight integrity of the vessel has been compromised. Temporary repairs may include fitting of doubler plates at the breached locations, fitting of additional stiffening / supports internally in the FPT, as well as frequently temporary cement box erection internally for ensuring watertightness of the compartments.

Permanent repairs: Consist of cropping and renewal of all affected steel structure whilst the vessel rests on keel blocks in dry-dock. Prefabrication of bow sections may prove to be the optimum and most cost/time effective practice, always subject to the extent of damage.

The issue in 2024

An issue faced by vessel managers and consequently insurers this year is the application of sanctions and all repercussions arising in terms of normal trade. It has been observed that vessels with ice damages occurring in St. Petersburg/ North Baltic Sea (after or during loading or discharging) have a difficulty being allowed to enter a different port in the Baltics for usage of a lay-by berth. Based on cases handled this year, the vessels might not even be allowed to enter any port within Europe, depending on the cargo on board.

Vessels in ballast have a better chance, and we have seen vessels steam on own power to ports like Klaipeda or Las Palmas for temporary or permanent repairs.

Damage Repairs – Latest status on current costs and yard / drydock capacity and availability

For the past 12 months, our global office network has been involved in numerous casualties, resulting to damage repairs of varying nature and scale. Particularly in the post Ukraine war commencement period – since February 2022, the persistent ‘zero Covid’ policy remaining applicable in China (impairing accessibility and timely execution of damage repairs), as well as the hectic rush for outfitting vessels with Water Ballast System, has created a damage repair environment of higher costs and limited yard/drydocking slots availability, particularly for emergency/mandatory repairs on keel blocks before continuing voyage or trading.

In light of the above we initiated since February 2022 a comparative research on damage repair costs (per records available from our case files) and availability of regional yards / Dry-docking facilities globally, focusing on aspects such as costs/congestion for both Owners/Class purposes works and damage repairs, for handy size to ultra-large vessels. In this context, we took the opportunity to research and prepare a database regarding the Dry-docking availability for Ultra-large vessels, focused on the main global repair regions.

Based on the extensive “dig” in our database by our Partners and Surveyors and in continuous interaction with our Principals – The Hull & Machinery Underwriters – which is ongoing, we are focusing on the damage repairs main cost drivers, which may be summarized as follows:

- Location of Yard

- Nature/quantum of damage and thus required repair period thereof

- Type / Size of ship

- Dry-docking dues (first / last day; daily dues)

- Wharfage dues

- Yard general services (wharfage & provisions)

- Steel work costs (ALL-IN – based on base unit price and after customary uplifts and satellite costs)

- Coating works

- Skilled / unskilled labour manhour unit costs

In close cooperation with our Principals, we are currently in the process and making efforts for preparing a comprehensive database for repair costs comparison around the world, focusing on the quoted or invoiced amounts charged by respective facilities, with the first summary of results expected to be compiled within 2023.

Based on the data collected and our experience to date, the following important aspects are currently assessed, with regard to the geographical importance and current state of repair facilities in respect of availability and costs:

China / Singapore – South East Asia

- Since the Covid outbreak at the beginning of 2020, all shipyards in China imposed various policies / pandemic control measures (crew covid test, shipboard disinfection, quarantine etc.). Meanwhile, various energy & raw material costs also considerably increased to some extent in past 2 years, which directly / indirectly resulted in repair cost inflation.

- Installation of Ballast Water Treatment and Exhaust Gas Scrubber units during the years 2020 & 2021 (peak time) but continuing into 2022, caused extreme congestion in shipyards (lack of drydocking/repair slots), which contributed to damage repair costs inflation, being largely volatile between yards in China.

- In 2022, congestion is ‘topped up’ with the delays resulting from restrictions related to the state ‘zero covid’ policies still prevailing. The latter has made Owners to refrain from carrying out large scale repairs in China since last year, consequently resulting to increased congestion in Singapore and other regional yards in South East Asia. Otherwise, the drydocking capacity for any type/size of vessel is available in China and will be so. We would also note that yards tend to quote higher rates for damage repairs (for both DD dues and steelworks) as compared to routine drydocking for Class purposes (especially when fleet contracts are involved with large fleets which have priority).

- An apparent annual percentage inflation of 20-30% has been observed on Dry-docking and Wharfage charges and 5-12% increase in steel renewal costs by the end of 2021. However, figures have further increased within 2022 due to the situation prevailing throughout the global economy and material supply chain post Ukraine war, with dramatic rise in energy/transport costs.

- Service Engineers’ fees are subject to work scope and Makers’ tariff rates. However, we may comment that there is a 20% – 40 % (average 30 %) annual increase on Services fees in 2021. These inflations may be mainly related with Covid Restrictions in China, which affects Service Engineers` traveling / and waiting time prior attendance on board (added charges for compulsory quarantine period time). Otherwise, Some of Service Companies also additionally charge extra amounts on account of Covid related issues (tests etc).

- Increased cost of supply of spare parts are generally related with shipping / freight costs, which are significantly increased and much higher than before – reaching very high levels when heavy large components are transported, such as new propellers, tailshafts, crankshafts, short blocks etc, requiring specialized logistics. Therefore, apart from transportation cost, spare parts / engine components’ price also increased recently due to increments of transportation cost for the raw materials to Manufacturers / Makers premises. Although, it still is difficult to accurately comment on the rate of inflation, it may be estimated that 10% – 30% (average 20 %) inflation on engine parts / components, varying between different Makers and components material/design or type.

Turkey

- The main shipyards located in Tuzla and Yalova are almost fully occupied and congested, giving DD availability for Class Surveys at least 2-3 months upon approaching (as a minimum). This is due to Water Ballast Treatment plant outfitting on the majority of vessels calling for Class Surveys to meet the deadline and this applies to all vessels size/type.

- Nevertheless, slots may be found for emergency repairs by re-adjusting their schedule – however rarely immediate. Therefore, if the damage repair cost is relatively small and there is no associated Owners work for giving some additional turnover, the quoted DD and wharfage rates are quoted at higher levels, if not substantially increased particularly if vessels’ stay is extended due to additional damage discovered during inspections.

- Lastly and given the current congestion, there are valid ‘rumors’ recently that large fleet shipping companies (Greek or other Nationality) are seeking fleet contracts by also ‘pre-booking’ drydocking space ahead by giving ‘range period dates’ for vessels’ calls.

- An apparent annual percentage inflation of 15-20% has been observed on Dry-docking and Wharfage charges and 30-40% on base unit steel renewal rate in 2022, as most of the steel supply for Tuzla/Yalova yards was always from Ukraine steel products factories – the largest having been destroyed in the war. These figures are expected to rise further as we enter in 2023.

- An inflation of 100% is reported by yards on the supply cost of steel materials, when comparing 2020 vs 2021.

- The main factor in Tuzla region for higher costs remains the non-availability of DD space (currently both Tuzla and Yalova repairs zones are extremely congested with dry-docking slots), which affects both time / cost of repairs on account of damages “discovered’ in addition to those scheduled. In such cases, extended time both at berth or in DD is being charged at higher dry-docking dues than originally quoted. Such issues are also causing repair time delays until next availability.

Greece

- The repair scene in Greece has changed after Cosco established their presence in Piraeus by the OLP take over – increasing the container terminal / trade capacity to record-high levels and adding to the D/Docking capacity, by the addition of their new floating dock (accommodating up to Panamax size).

- Takeover of the Syros Island Neorion Shipyards by Onex (with Chalkis Shipyards management also practically under their wing) added to the revamping of the repair capacity, along with Spanopoulos yard (at Salamis Island – across Perama), who also provide a floating dock of Panamax capacity.

- Thus, increased volumes of Class / Damage repairs are now seen over the recent years, with the above yard options for the moment, until Skaramanga (Hellenic) Shipyards are hopefully reactivated for commercial operation (after their recent take-over by George Prokopiou interests).

- On very recent news, on 24th Nov 2022, the first vessel berthed at Elefsis Shipyard for repairs alongside, after a long idle period of the shipyard for approximately 4 years. The shipyard will be managed by Onex with a revamping which was long awaited by the local industry. A ceremony with local Government and Authorities was held on 25th November for the celebration of the shipyard’s reactivation, which creates some promising circumstances for the recovery of the area’s ship repair sector.

- Given the above and rather limited availability of yards berth or D/D space, Perama Repair Zone based contractors still provide a good option for high quality machinery & hull repairs, mainly afloat at Perama, using the OLP/COSCO repair berths & floating docks for any repairs on keel blocks (but not of large scale/extended dry time)

- With regard to steel renewal unit price for repairs in Greece – as opposed to Turkey – it is rather difficult to pin point a reference price, as this is a variant of multiple parameters for repairs in both Yards and/or Perama (subject to location, quantum, availability etc).

- An apparent annual percentage inflation of 10-15% has been observed to steel renewal costs base price whilst a 15-25% to steel prices after application of increments by the end of 2021. These figures are again expected to rise entering 2023 due to the situation prevailing throughout the global economy and material / energy supply.

SUMMARY

With the global economy now in turmoil due to the energy crisis, the increasing pressure for sustainable industries as well as the effect of global increase of inflation rates due to the Ukraine war, the ship repair industry is facing a general increase in costs and considerable congestion with respect to the availability of facilities.

As the oil and gas prices are continuously rising, it is expected that all dependent products and heavy industry consumers shall be forced to further increase their prices, in order to compensate for losses on facility expenses, transportation, forwarding, machinery operations, manufacturing processes and subsequently labour costs.

To the date of drafting this article, it is not clear as to when or where the global increase of prices will stop, and this is a major factor impacting the overall stability of the shipping industry as a whole, and the ship repair subsector under review in this specific article. It is evident however that in the current globalized market, geopolitical uncertainty, and its effect to the disturbance of energy prices and supply chains, have a negative impact on the overall cost/time that ship repairs require.

It will be interesting to see the results of our analysis on repair cost drivers database by the end of 2023 and how the global developments will have affected our research until then.

For inquiries regarding further information on ship repair facilities, repair costs and more, please do not hesitate to contact us at piraeus@evedmonpartners.com

Market Update – Damage Repair Costs: The Effect of Rising Inflation & Energy Costs

After the pandemic faded in early 2022, the Ukraine War outbreak in Feb 2022 caused a shock across the globe, with sharp increases in energy prices and rising inflation rates to levels unseen for decades.

Such developments disrupted the ship repairs costs & time once again, to a variable degree per major repair hub/region, causing considerable increases in yard services and steel renewal rates, labour/machinery repair costs, adversely affecting repair completion time and causing congestion in yards (combined with deadlines for fitting BWT systems & Scrubber units).

Having reviewed our case files in this respect, in this article we elaborate on the effects and consequences of the Ukraine war outbreak and sharp rise of energy costs and rising inflation rates, after a comparison of repair costs charges/tariffs based on our records for 2021, 2022 & 2023 (6 months – up to end of June), together with our comments thereof, incorporating the latest developments as summarized hereunder:

A. China / Singapore – East Asia

- Despite the global inflation rates, the general impression for the first half of 2023 is that the shipyards tariffs and charges in China are maintained at generally stable and competitive levels (or even in cases, slightly less than before), without any apparent inflation in repair cost levels compared with 2022.

Thus, Yards in China remain a competitive and preferred option for damage repairs (always subject to drydocking space availability per circumstances prevailing. - As widely known, all shipyards in China had previously imposed various Covid control measures / restrictive policies, such as crew Covid test, shipboard disinfection, quarantine, etc., which remained in place throughout the 2nd half of 2022, resulting in delays and increased cost of damage repairs.

- However, in December 2022, Chinese Government gradually uplifted all Covid related restrictions, a positive development which apparently gave a boost to the ship repair industry in terms of material, transportation, spare parts delivery, competitive labor costs etc.

Also, following the lifting of Covid related restrictions in Dec 2022, Yards waived any additional fees relating to Covid-19, consequently resulting to substantial savings in the overall repair costs per repair project (depending on nature/extent/time) in the region of USD 50K-100K, as compared to end of 2022, by way of agency costs and extra yard services reduction, elimination of Covid restrictions costs, less costly and timely service engineer attendance, improved spare part delivery time/cost, etc. - Thus, recent yard tariffs/charges regarding steel works, coating works and machinery works (in terms of both labour and spare parts), indicate no inflation for the first half of 2023, compared to 2022.

- As an example, indicative typical base steel renewal unit cost and average resulting steel renewal costs remain unchanged since 2021, as indicated in the table below:

steel renewal unit base price USD 2.0 ~ 2.6 / KG steel price after applying percentage increment USD 3.2 ~ 7 / KG - In view of the above, and since the additional difficulty of Covid-19 restrictive policies has now been eliminated, China is set to remain as a leader in the ship repair industry, both for damage repairs and routine drydocking works.

B. Turkey

As compared to our previous bulletin on repair costs in TR shipyards the following developments apply, due to both global but also sharp local inflation rates sharp increases, namely:

- There is a high rise in labour costs due to TR economy high inflation rates – affecting all repair costs. Average percentage increments on base unit cost have also been subjected to inflation, always subject to scope and quantum of renewals.

- An increase of 100% (even more) is reported by yards on the supply cost of steel materials, when comparing 2021 vs 2022. Such inflation is expected to further increase by 25% – 30% in the 2nd half of 2023. Nevertheless, such increase in materials supply cost is NOT reflected proportionally on the reciprocal steel renewal charges % increases, which are kept to much lower levels, for maintaining a competitive commercial position as a leader in steel renewal repairs in the Mediterranean Sea basin.

- In this respect, Yards are currently ‘sustaining’ a significant decrease on the profit margin for steel works, also combined with the significant increase on the labour costs due to continuous domestic inflation rate hikes.

The indicative typical currently applicable steel renewal rates and % running inflation rate are shown in the table below.Items Average rate in 2021 Average rate in 2022 Average rate in 2023 Expected Percentage Inflation (%) (2022 vs 2023)

steel renewal unit base price USD 2.8 ~ 3.2 / KG USD 4.0 ~ 4.5 / KG USD 4.5 ~ 5.5 / KG 25% ~ 30% steel price after applying percentage increment USD 4.0 ~ 4.5 / KG USD 5.0 ~ 5.5 / KG USD 5.5 ~ 6.5 / KG - Moreover, the main factor in Tuzla region for delays & thus higher overall resulting costs remains the non-availability of dry-docking space (currently both Tuzla and Yalova repairs zones are extremely congested without dry-docking slots readily available). This affects both time / cost of repairs on account of damages “discovered’ in addition to those scheduled prior vessels’ calling at yard. In such cases, extended time both at berth or in DD is being charged at higher dry-docking dues than originally quoted. Such issues are also causing repair time delays until next availability.

Nevertheless, despite all the above, Turkish Shipyards and repair industry remain competitive and economical overall, as far as prevailing tariffs, repair / maintenance period and quality are concerned, thus a major repair hub in the East Med and a valid choice.

C. Greece

Perama repair Zone is seeing increased vessels’ calls for both routine Class crediting works and dry-dockings, as well as damage repairs.

Since its reactivation in November 2022, Elefsis Shipyard (also under ONEX group management) is enjoying the support of Greek Shipping with numerous vessels calling for damage repairs.

In latest news, on 11th July 2023 the re-activation of first floating dock materialized, able to accommodate vessel’s up to 75,000 DWT, with another two floating docks (22K and 120K DWT) currently under reactivation works and soon to be delivered.

Moreover, privatization procedures of Hellenic Shipyards (Skaramangas) have now been officially completed, with the yard having been taken over under the G.Prokopiou group ownership and management, pending re-activation for commercial operations/contracts.

Once Elefsis Shipyard is restored to full DD capacity and Skaramangas Shipyard re-open for commercial business, Piraeus ship repair scene is expected to greatly restore status/capacity to previous high efficiency years.

Finally, Perama based contractors remain a valid and highly skillful competitive option for both hull and machinery repairs afloat, alongside Perama Repair Zone repair quays (or double berthing), providing a wide variety of repair options and solutions.

Having summarized the overview of current developments above, we would refer to the effects of inflation and energy prices hike on current yard/contractors’ tariffs and damage repair costs in brief summary hereunder, as follows:

- Steel material purchase price now averages Eur 1.40-1.60/kg – as opposed to Eur 0.7/kg since 2020 up to Jan 2022 (before the war) & 1.25/kg in 2021 to 2,60/kg in summer 2022 (after the war outbreak). As Greek contractors were previously outsourcing steel material, plates & profiles from Ukraine, this option has been significantly altered after the war outbreak, resulting to skyrocketing of steel supply costs.

- A 100% rise in pipe purchase prices experienced (for 1”-6” diam)

- Steel renewal average base unit rate of Eur 9.0/Kg applies for Perama Zone, with exceptional cases where a base unit rate of Eur 6.0 / Kg was applied (as a rock bottom).

- The overall resulting steel renewal unit rates after application of % increments, varies between EUR 10.0 and 15.0/KG on average depending on nature, quantum & location of renewals.

- Yards congestion with scrubber/WBT systems sustains berth/DD slots availability limited.

Perama based contractors for machinery repairs report inflation rise since 2020/2021 (due to war outbreak), as indicated below:

- A 50% rise in new equipment / machinery / components purchase cost.

- Adding to that is a 100-120 % rise in transport/freight costs, with a correction tendency to lower rates.

- Raw materials purchase inflation by 20-30%, escalating to anything between 100-150% inflation for specialized materials (eg. stainless steel).

- Minimum delivery times of 3 to 4 months upon order experienced until recently, however now drastically improving.

- Labour cost has risen by 20-30%

D. Gibraltar Strait – Spain, Portugal & Canary Island

Our Gibraltar office surveyors, who operate and attend in all shipyards across Spain, Portugal and Canary Islands report as follows on the main aspects of interest for damage repair costs and inflation thereof:

D1. Gibraltar – Spain

- Drydocking dues / General Services: An average increase of 10-15% applies between 2021 & 2023, with electrical power costs reaching as high as 20%.

- The average unit steel renewal costs and inflation thereof are indicated in the table below:

| Items | Average rate in 2021 | Average rate in 2022 | Average rate in 2023 | Percentage Inflation (%) |

|

steel renewal deck/shell & bottom plating

base price |

USD 9-10.00 / KG | USD 10-11.00 / KG | USD 12-14.00 / KG | 20-25% |

- Labour costs for machinery repairs were subjected only to 10% inflation on average, without any apparent inflation on coating works.

D2. Portugal

- Drydocking dues / General Services: Unlike Spain, NO significant inflation was observed on DD dues and services between 2022 & 2023, with increases in electrical power costs reaching 10-15% on average.

- The average unit steel renewal costs and inflation thereof are indicated in the table below:

Items Average rate in 2021 Average rate in 2022 Average rate in 2023 Percentage Inflation (%) steel renewal deck, shell & bottom plates base price

USD 8-9.00 / KG USD 10-11.00/ KG USD 12-13.00/ KG 15%

D3. Canary Island

Drydocking at Las Palmas is limited to Astican syncrolift capacities and 7 docking slots (12.000 MT, Lmax: 190m and Bmax: 28.5m) and Zamakona slipway max capacities 5500 MT 5 slipways ready to dry dock ships of maximum dimensions of 123 meters long and 21 meters beam.

Also available in Astican is a 120 meters long wharf/repair quay with a maximum draught of 7 meters, for repairs afloat.

NB. It has been recently announced that a new floating dock will be soon available at Tenerife Shipyard (Hidramar Group) next year, with reported capacity to accommodate vessels up to 200 m length (Capacity and commencement of operations to be confirmed).

Otherwise, the following apply with regards to repair costs inflation:

- Similarly to Portugal, NO significant inflation was observed on DD dues and services between 2022 & 2023 (including electrical power costs).

- The average unit steel renewal costs, which are not subjected to any apparent inflation since 2021 thereof, are indicated in the table below:

| Items | Average rate in 2021 – 2023 | Percentage Inflation (%) |

|

steel renewal deck, shell & bottom plates

base price |

USD 7-7.75 / KG | No apparent inflation |

SUMMARY

– China:

It is significant and to the mutual benefit of both the Shipping and Insurance industries that there is not any notable inflation in yard tariffs and repair costs. Thus, China remains a leading and cost-effective repair hub, currently perhaps only showing a limited Drydocking availability/slots for emergency unscheduled repairs due to congestion on Class related works involving also bookings by large fleets under the same Ownership / Management.

– Turkey:

Despite a continuing local economy high inflation, shipyard tariffs / repair costs are kept under control as much as possible by the local shipyards for maintaining commercial competitiveness, thus, Tuzla/Yalova repair zones remaining the most competitive and cost-effective repair hubs in the Mediterranean Sea basin.

– Greece:

The full re-activation of the shipyards and the re-birth of the local ship repair/shipbuilding industry under private ownership and management is already a fact and rapidly progressing/materializing. Although repair tariffs / costs vs Turkey, are subjected to the Eur/Usd exchange rates fluctuation and may be somewhat higher, the Perama Repair Zone and Elefsis/Syros shipyards (under the ONEX group management), still present a competitive and time / cost effective choice for damage repairs, with particularly qualified and skillful private contractors particularly for machinery repairs, whilst Chalkis and Spanopoulos shipyards are now expected to maintain / upgrade standards since healthy competition has entered the market. A problem currently faced is the limited or even non availability of DD slots for e/cy – unscheduled repairs, which is expected to drastically improve in the near future when Elefsis & Hellenic shipyards drydocking capacity is added to the play.

– Gibraltar-Spain/Portugal/Canary Islands:

Although traditionally a generally more costly option if compared to the remainder three repair regions above, it seems that it has not been significantly affected by the inflation caused by the energy costs disruption after the outbreak of the Ukrainian war. Only a mere 10% – 15% hike on average is observed for Spain steelwork and DD dues, whilst there were no noteworthy effects or inflation generated increases applicable in Portugal or Canaries (Las Palmas). This consists a positive development for the Shipping & Insurance industries, as the shipyard/repair facilities in SW Europe (Spain, Portugal and Las Palmas on emergency circumstances) were always proven to be either the most cost-effective alternative (as compared to Western France and NW Europe) or frequently the only option for casualties occurring in the Atlantic/West Africa areas or vessels towed therefrom.

Finally, shipyards in Spain & Portugal, have successfully achieved at relatively competitive cost/time, some highly demanding and complex repair projects, which our surveyors of Gibraltar & Piraeus offices have attended, such as large scale 2-stroke engines (MAN/Wartsilla) repairs involving, crankshaft or even bedplate renewal / machining, or even – in Gibdock/Gibraltar- complex fire damage repairs on high technology PSV’s and Fishing factory trawlers, thus constituting an important regional repair option/hub.

Survey Familiarization Course 2025

A combination of hands-on experience and industry insight

A one-day Survey Familiarization Course took place a few days ago at OLP, Elefsis, and Skaramangas Shipyards, offering a unique opportunity for professionals from The Swedish Club and UK P&I Club to gain first-hand experience in a shipyard environment.

A total of 10 participants spent a full day “on the field” under the guidance of Nikos Drikos and Stelios Paterakis, visiting shipyard facilities and boarding vessels currently under repair. The course provided practical exposure to key technical aspects of claims handling, helping attendees develop a deeper understanding of ship structures, machinery, and repair processes.

We are particularly grateful to OLP Shipyard, Elefsis Shipyards, and Skaramangas Shipyards for accommodating the course and taking the time to guide the group through their facilities. Their support was once again essential in ensuring that such initiatives continue to bridge the gap between theoretical knowledge and real-world application.

Survey Familiarization Courses 2023

A combination of acquiring hands-on knowledge and team-building

During two separate Survey Familiarization Courses that took place in Tuzla and Yalova, Turkey in May and October a total of 40 professionals from international insurance market communities participated, the majority being claims handlers from H&M Underwriters and P&I Clubs, but with a mixture of marine insurance Brokers and Solicitors.

A special thanks goes out to everyone involved in DESAN Shipyard (Tuzla), KUZEY STAR Shipyard (Tuzla), Besiktas Shipyard (Yalova), as well as to the Istanbul Maritime Academy for granting us access and taking time off their busy schedule to escort the various groups in their premises.

As always, the main purpose of our Familiarization Course has been to introduce and demonstrate the local Shipyards facilities, workmanship skills and cost effectiveness, as well as the main aspects of ship design and machinery, outfitting and equipment, versus risks undertaken by Underwriters on board vessels both afloat and on keel blocks in dry dock.

The surveying practices as globally applied by the Evdemon & Partners Surveyors Teams in all of our eleven offices worldwide were explained on the spot. Realizing the actual scale and size of the vessels as well as complexity and sophistication of several components is most certainly the biggest gain to the participants. Things tend to look different on paper or in photos compared to reality!

We are extremely thankful for the positive feedback we have received from the attendees, as it acts as a motivator for us to continue hosting such courses in the future.

Stay updated for further announcements on https://evdemonpartners.com/category/news/

Survey Familiarization Courses 2022

A combination of acquiring hands-on knowledge and team-building

After a mandatory break of two years, due to the Covid-19 restrictions, we were again in the fortunate position of hosting our Survey Familiarization Course. Due to the high demand for participation, we hosted three separate Survey Familiarization Courses, two 2-day courses in Tuzla, Turkey and one 1-day course in Piraeus Greece, during September and October.

One of the 2-day courses that took place in Tuzla Turkey was dedicated to the Lloyd’s Marine & Energy U35s Insurance Group. Overall, during this year’s courses a total of 45 professionals from international insurance market communities participated, with a mixture of claim executives and underwriters from H&M Underwriters, P&I Clubs, Average Adjusters, Marine Insurance Brokers and Solicitors.

A special thanks goes out to everyone involved in DESAN Shipyard (Tuzla), KUZEY STAR Shipyard (Tuzla), TERSAN Shipyard (Yalova), Turquoise Yachts (Pendik) as well as COSCO – OLP Repair facility (Perama) and SPANOPOULOS Shipyard (Salamina) for granting us access and taking time off their busy schedule to escort the various groups in their premises.

As always, the main purpose of our Familiarization Course has been to introduce and demonstrate the local Shipyards facilities, workmanship skills and cost effectiveness, as well as the main aspects of ship design and machinery, outfitting and equipment, versus risks undertaken by Underwriters on board vessels both afloat and on keel blocks in dry dock.

The surveying practices as globally applied by the Evdemon & Partners Surveyors Teams in all of our eleven offices worldwide were explained on the spot. Realizing the actual scale and size of the vessels as well as complexity and sophistication of several components is most certainly the biggest gain to the participants. Things tend to look different on paper or in photos compared to reality!

One of the highlights for one group of attendees was boarding an ongoing new building hybrid design coastal passenger vessel, led by the Project Engineer, who provided an overview of the detailed propulsion system, switchboards & control panels operation, battery system configuration and capacity, engine room systems, LNG tank configuration and general lay-out of the new building project. Being lucky enough to grab such an opportunity is certainly a rare occasion!

We are extremely thankful for the positive feedback we have received from the attendees, as it acts as a motivator for us to continue hosting such courses in the future. Stay updated for further announcements on https://evdemonpartners.com/category/news/