Cargo crane slewing bearings damage - slewing pinion gear found in contact with pedestal post flange

It is rare to see such excessive loss of clearance between the slewing pinion and the pedestal post flange. Great attention is required by crew during loading operations, especially when same are carried out at anchor. It is imperative that all operating conditions are within Makers’ limits and that stevedores are notified to halt operation when same are exceeded – in addition to standard preventive maintenance procedures (rocking tests, greasing, sampling etc).

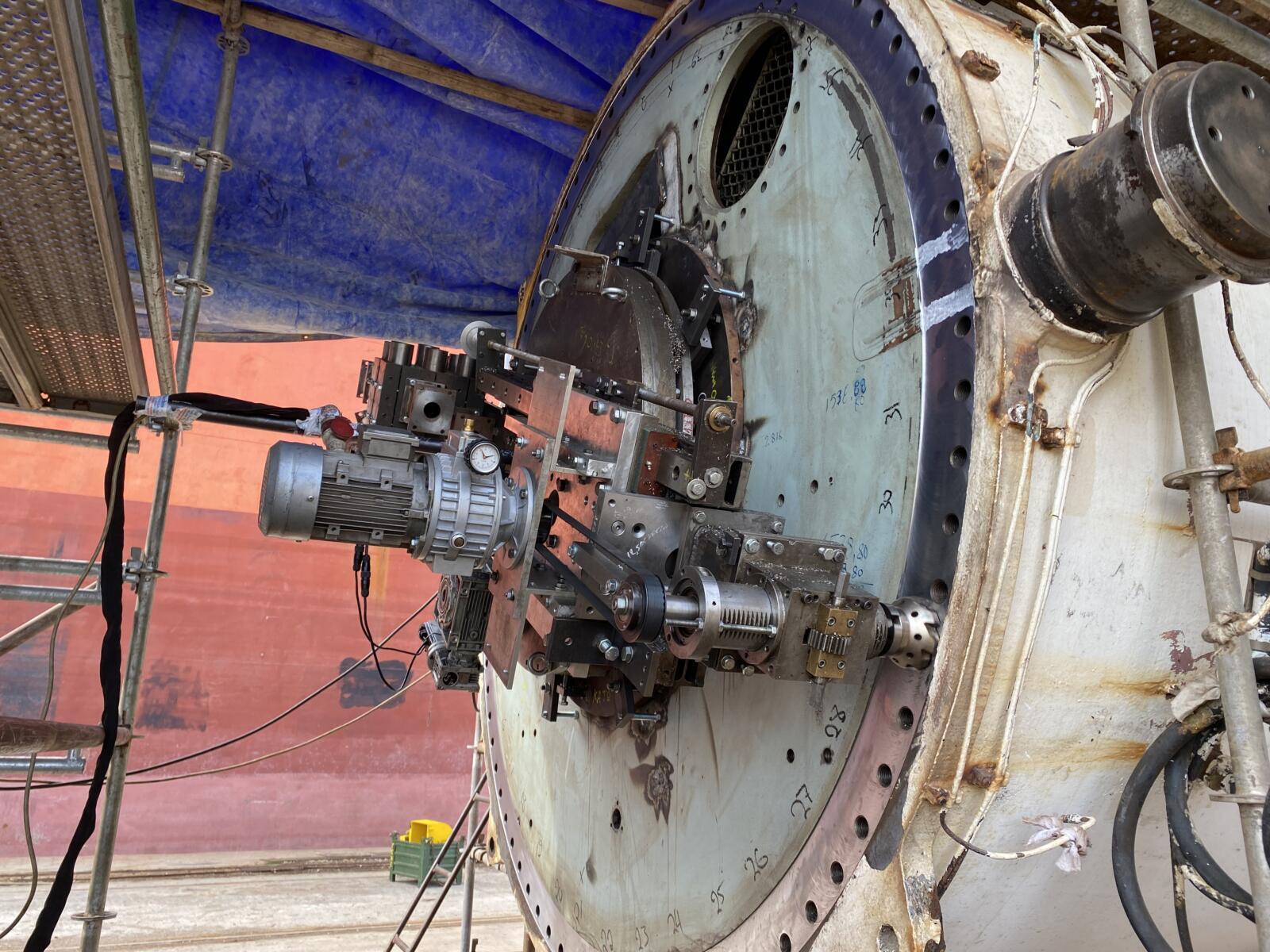

Repair Process

In this case, slewing rings renewal was required, which involves machining of both pedestal and turret post flanges, to comply with new slewing rings flatness tolerances which may be as low as 0.2mm.

Initially, and once turrets have been removed ashore by use of mobile cranes, laser alignment measurements were taken to verify the flatness of pedestal and turret post flanges. Subsequently the machining of the surfaces was carried out with a special tool provided by local Piraeus contractors, and machining required an average of 2 days to complete per flange, subject to weather conditions prevailing.

In order for the above to be carried out, custom cradles were fabricated in order for the tower posts to be placed horizontally on pier, for easier access of the machining tool.

Repairs were carried out whilst vessel was fastened alongside a repair berth at Piraeus. Our Piraeus Head Office Surveyors continuously attended on site and at workshop, as always providing our proactive advice to H&M Underwriters with regards to progress of repairs and estimated costs.

POSIDONIA 2022

We have been delighted to celebrate this year’s Posidonia with a cocktail reception held at the Aikaterini Laskaridis Foundation, welcoming prominent figures of the international Underwriting, Broking communities, maritime solicitors, Average Adjusters as well as representatives of major Greek Shipping firms.

As evident in all industries, COVID-19 took a toll on all in-person networking events during its two-year reign, and this was seen in the attendance numbers throughout the Posidonia 2022 period after restrictions were lifted. It was exciting to see such response from the worldwide shipping community, and we are glad that colleagues, clients and friends finally had the chance to travel to Greece and connect, as well celebrate our efforts in this industry, at the Posidonia which we believe will remain as the most successful and memorable of the past decade.

It was a much-needed chance to celebrate strong and long-lasting business ties and friendships.

Thank you all for joining us!

EU 6TH SANCTION PACKAGE: CARRYING RUSSIAN OIL AND PROVIDING RELATED INSURANCE SERVICES IS NOW BANNED – A SUMMARY

As the war between Russia and Ukraine continues, the 6th package of sanctions to Russia has been introduced by the EU council on 3rd June 2022. The regulations put in force aim to cut oil imports from Russia by 90% by February 2023.

The EU sanction package includes the following key regulations:

- Ban of sea transport of Russian Crude / Petroleum products to EU ports.

- Ban of Insurance / Reinsurance services by EU companies related to the transport of Russian crude/petroleum products to third countries

Per wording of Article 3m of the regulation, from 4th June 2022:

- It shall be prohibited to purchase, import, or transfer, directly or indirectly, crude oil or petroleum products, as listed in Annex XXV, if they originate in Russia or are exported from Russia.

- It shall be prohibited to provide, directly or indirectly, technical assistance, brokering services, financing or financial assistance or any other services related to the prohibition in paragraph 1…

The Transport Ban

The seaborne EU imports of crude / petroleum products have now been prohibited, with a phase out period allowing for sport market transactions and execution of existing contracts to be completed by 5th December 2022 for crude oil, and by 5th February 2023 for refined oil products (i.e. permitted for 6 and 8 months of entry into force respectively).

The transport regulation however does not prohibit the transport of crude oil or petroleum products exported from Russia to a third country.

The Insurance Ban

Article 3n of the regulations provides that:

- It shall be prohibited to provide, directly or indirectly, technical assistance, brokering services or financing or financial assistance, related to the transport, including through ship-to-ship transfers, to third countries of crude oil or petroleum products as listed in Annex XXV which originate in Russia, or which have been exported from Russia.

- The prohibition in paragraph 1 shall not apply to:

(a) the execution until 5 December 2022 of contracts concluded before 4 June 2022, or of ancillary contracts necessary for the execution of such contracts; or

(b) the transport of crude oil or petroleum products as listed in Annex XXV where those goods originate in a third country and are only being loaded in, departing from, or transiting through Russia, provided that both the origin and the owner of those goods are non-Russian.

As a result, although Owners may be engaging in lawful transport of said products, an insurer subject to their jurisdiction (EU) will not be able to provide insurance for such trade.

The Next Months – Questions & Uncertainty

In 2021 alone the EU imported some €48 billion worth of crude oil and some €23 billion of refined oil products. With the embargo of these products coming into force, the EU is aiming to a large scale reduction of Russian revenue. Is this the result?? Latest news suggests the contrary

An important question is raised on how this will affect the EU countries that are most dependent on Russian oil imports. It is noted that a large number of EU countries rely more than 20% of total imports on Russian crude / refined oil products. Given the sanctions put in force, the cost of oil imported by EU countries is expected to rise, thus having direct impact to consumers.

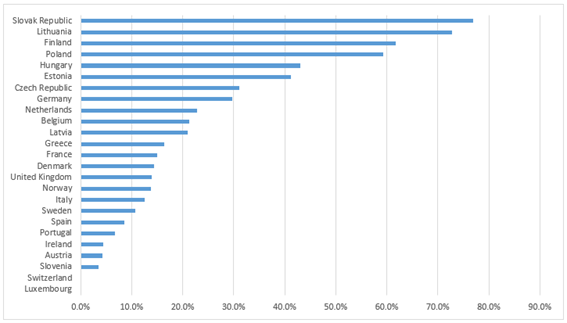

Dependence On Russian Crude Oil & Products

Percent of total imports, monthly average, 2021

As far as prohibiting the transport and import of Russian oil products by the EU Member States, many shipowners expressed their reservations at first, arguing that the prohibition would only result to the products being diverted to third countries, and subsequently sold to the EU at higher prices, thus just “penalising ourselves” as Capital’s Mr. Marinakis expressed during the Tradewinds Shipowners’ Forum during Posidonia 2022.

With the insurance ban however, there is additional risk for Owners, as shipping of oil products from Russia with insurance or reinsurance provided by entities domiciled within the EU is prohibited (UK is expected to follow suit). This is expected to provide resistance to Russia’s efforts to redirect crude / refined oil products to third countries outside the EU. In addition, it is expected that shipowners will show reluctancy to carry Russian oils whilst not being insured for such trades.

It is possible however, that insurance providers in Russia, China and India will step up to facilitate such trades, but the insurance ban is expected to be the most consequential move to restrict Russian oil exports to date.

In any event, since spot market transactions are excluded from the regulations for the initial phase in period, it is possible that Russian exports to Europe will see an increase in the coming 6-8 months, as refiners may try to increase their input – possibly at discounted rates – in order to build their inventories prior the trade becomes illegal.

In summary, there is potential to be found within the sanctions imposed, however it is not clear yet that this package of has or will accomplish the goal of the EU, i.e. to deprive a significant amount of revenue from Russia, while minimizing the cost to EU consumers and the global market.

SHANGHAI OFFICE / CHINA – POSITIVE DEVELOPMENTS: SHANGHAI LOCKDOWN UPLIFTED

Very strict Covid related restrictions with eventual complete lockdown (curfew) for at least 60 days, had been implemented by Chinese Authorities in Shanghai and likewise in other major ports/cities in China since the end of March 2022.

Shanghai, a city of 25 million people, was eventually shut down totally in April and May 2022, with the Government Authorities supplying basic provisions to the local residents, who were not even allowed to exit their home. Likewise, traveling in & out of the major Shanghai province was forbidden.

This resulted to a very serious disruption of trade and thus supply chain of commodities / materials and spare parts.

Moreover, vessels scheduled for Class surveys/ drydocking or damage repairs were diverted to other ports / yards in South East Asia, mainly Singapore, Vietnam, Indonesia and other regional countries with yard/repair facilities. As a result, enhanced removal (either on own power or under tow) and/or repair costs may have been and are still being faced by H&M UWS.

As far as accessibility to yards/terminals and diversification of vessels for scheduled repairs in China, our Shanghai office managed to sustain the lockdown, by strategically stationing members of our surveyors’ team outside the major Shanghai area throughout the curfew period, who were free to travel and attend vessels calling at other ports/yards in China, always though subject to local covid restrictions and regulation as applicable at the different ports/terminals across China. Those remaining in Shanghai, continued working from home, always with the support of our Piraeus and Istanbul offices, by timely enhancing their IT capabilities and accessibility to our global servers.

Simultaneously, our Singapore office saw an increase in casualty instructions, absorbing part of the vessels’ influx for damage repairs in the regional yards or lay-by berths, which would otherwise call at yards in China.

On an optimistic note, as Shanghai was recently declared as a non-risk region for Covid since 1st July 2022, restrictions are gradually being uplifted, with latest total opening for travelling and free commuting to other provinces. Therefore, our Shanghai office surveyors have now resumed full scale travelling to all ports/yards throughout China attending on board vessels, whilst our Surveyors which had been stationed and attending outside Shanghai province, have now returned to office and reunited with their families (after almost 3 months).

Concluding, both our Shanghai and Singapore offices remain fully active and open for business (though ‘not yet fully as usual’), whilst we all look forward to the improvement of worldwide circumstances and quick recovery of normal pace of life and supply chain globally.

MAJOR FIRE IN ACCOMMODATION SPACES AT LUANDA, ANGOLA – REPAIRS COMPLETED IN WEST AFRICA – TEMA SHIPYARD, GHANA

On 22/11/2021 a fire broke out in way of the accommodation house of an Oil / Chemical Tanker engaged in West African ports trading (under TC), during sea passage from Cabinda to Luanda Port in Angola.

Extensive fire damage was sustained in way of the upper deck accommodation, gutting the cabins/public spaces, including outfitting and entire electrical installation /cabling, which were severely fire / heat affected.

Our Ghana Office Surveyor, Julius M. Wilson promptly carried out the Initial attendance at Luanda Anchorage, Angola in order to ascertain the extent of damage and nature of repairs required thereof.

A detailed Damage Repair Specification was prepared by our local Office, which Owners submitted to suitable repair facilities in the vicinty such as Tema Shipyard (Tema/Ghana), Dakarnave (Dakar/Senegal) and Astican Shipyard (Las Palmas / Gran Canaria) inviting tenders.

Owners explored the possibility of carrying out permanent repairs at Angola, however Agents reported that there were no available lay-by berths to accommodate the vessel at Luanda port for such prolonged period. Thus, vessel had to remain at anchorage, where she would be exposed to weather conditions / high swell, jeopardizing the progress of repairs.

Moreover, the logistics of sending materials and technicians to repair the damages at Angola anchorage would significantly delay the repairs and would entail excessive costs.

By proactively assisting in the acquisition of competitive quotations, and upon scrutiny of available tenders, it was decided that the most convenient, safe as well as cost/time effective solution would be to effect permanent repairs at Tema shipyard in Ghana, where easier access of shore contractors and materials was possible.

Our Ghana office attended on site, monitoring repairs progress and costs involved thereof, whilst providing continuous advice to H&M Underwriters concerned. Some two months were required for repairs to complete, whilst the potential excessive costs that would arise under a lengthy removal voyage to other regions/facilities were avoided, to the benefit of all parties in the process.

As Ghana is part of the ECOWAS (Economic Community of West African States), our local Office Surveyor is able to travel visa-free and via direct flights to at least 10 major West African ports, and provide a cost/time effective solution for marine survey requirements in the region.